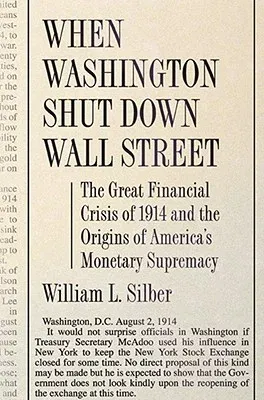

When Washington Shut Down Wall Street unfolds like a mystery story. It

traces Treasury Secretary William Gibbs McAdoo's triumph over a monetary

crisis at the outbreak of World War I that threatened the United States

with financial disaster. The biggest gold outflow in a generation

imperiled America's ability to repay its debts abroad. Fear that the

United States would abandon the gold standard sent the dollar plummeting

on world markets. Without a central bank in the summer of 1914, the

United States resembled a headless financial giant.

William McAdoo stepped in with courageous action, we read in Silber's

gripping account. He shut the New York Stock Exchange for more than four

months to prevent Europeans from selling their American securities and

demanding gold in return. He smothered the country with emergency

currency to prevent a replay of the bank runs that swept America in

1907. And he launched the United States as a world monetary power by

honoring America's commitment to the gold standard. His actions provide

a blueprint for crisis control that merits attention today. McAdoo's

recipe emphasizes an exit strategy that allows policymakers to throttle

a crisis while minimizing collateral damage.

When Washington Shut Down Wall Street recreates the drama of America's

battle for financial credibility. McAdoo's accomplishments place him

alongside Paul Volcker and Alan Greenspan as great American financial

leaders. McAdoo, in fact, nursed the Federal Reserve into existence as

the 1914 crisis waned and served as the first chairman of the Federal

Reserve Board.