Essential guide to getting your finances in order, planning for what you

need now and in the future. This tool by finance guru Lita Epstein

focuses on your turning point to a better financial position, making

life easier, less stressful and fun knowing exactly where you stand.

Whether raising your credit score, maximizing savings, dealing with

personal bankruptcy, deciding on insurance coverage, or focusing on

budgeting this guide targets the most important financial decisions you

need to make with facts and a clear path to follow to make it happen.

Seeing the most important financial decision guidance in 6 laminated

pages, easily referenced makes this an amazing tool that can change your

life for the better. At a price that will not hit your budget hard, it

can't be beat.

6 page laminated guide includes:

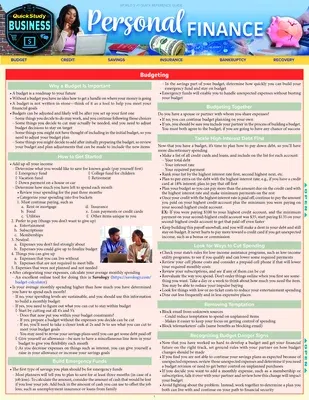

- Budgeting

- Why a Budget is Important

- How to Get Started

- Build Emergency Funds Budgeting Together

- Tackle High-Interest Debt First

- Look for Ways to Cut Spending

- Removing Temptation

- Recognizing Budget Danger Signs

- Improving Credit Score

- Why Care about Your Credit Score?

- What is a Credit Score?

- Getting to Know Credit Reporting Agencies

- Understanding Your Credit Report Correcting Credit Report Errors

- Exploring Credit Score Myths

- Maintaining Your Credit Score

- Protecting Your Credit Identity

- Savings

- Paying Yourself First

- Saving for Short-Term Goals

- Saving for Medium-Term Goals

- Saving for Long-Range Goals

- Use Multiple Savings Accounts

- Insurance

- Is Insurance Worth Budgeting for?

- Life Insurance

- Health Insurance

- Car Insurance

- Disability Insurance

- Liability Insurance

- Personal Bankruptcy & Recovery

- Chance to Restart Your Financial Life

- When to Consider Bankruptcy

- Two Types of Bankruptcy for Individuals

- Filing for Bankruptcy

- Repairing Your Credit History

- Getting Credit after Bankruptcy