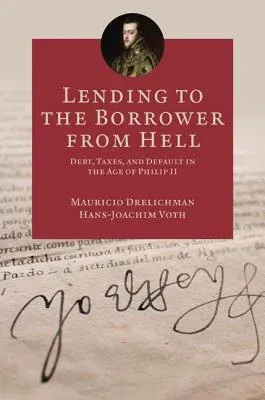

Mauricio Drelichman

(Author)Lending to the Borrower from Hell: Debt, Taxes, and Default in the Age of Philip IIPaperback, 13 December 2016

Qty

1

Turbo

Ships in 2 - 3 days

In Stock

Free Delivery

Cash on Delivery

15 Days

Free Returns

Secure Checkout

Part of Series

Princeton Economic History of the Western World

Part of Series

Princeton Economic History of the Western World, 47

Print Length

328 pages

Language

English

Publisher

Princeton University Press

Date Published

13 Dec 2016

ISBN-10

069117377X

ISBN-13

9780691173771

Description

Product Details

Book Format:

Paperback

Country of Origin:

US

Date Published:

13 December 2016

Dimensions:

23.39 x

15.6 x

1.88 cm

Genre:

Spanish

ISBN-10:

069117377X

ISBN-13:

9780691173771

Language:

English

Location:

Princeton

Pages:

328

Publisher:

Series:

Weight:

508.02 gm