If you're in business or a business major, audits will happen. Business

and accounting students or professionals involved in finances and

accounting often have a range of reactions to an audit, fear and

loathing being high on the list. Our experienced author, professor and

consultant Michael Griffin, MBA, CMA, CFM, ChFC details the auditing

process in a streamlined bullet pointed 6 page laminated reference guide

that provides a road map from start to finish with all stops in-between.

Designed for quick reference, you will find sections and specific

details fast. With a process that often happens annually it is nice to

have this handy refresher regardless of your experience level.

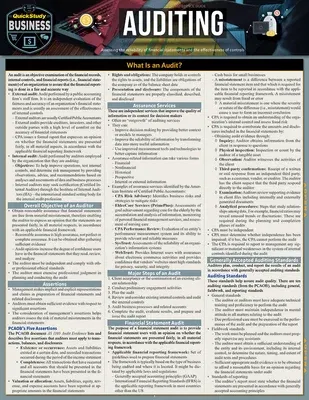

6-page laminated guide includes: - What is an Audit?

- Overall Objective of an Auditor

- Assertions

- Assurance Services

- Major Steps of an Audit

- Financial Statement Audit

- Generally Accepted Auditing Standards

- Auditor's Report

- Sample Auditor's Report

- Compilation

- Review

- Engagement Acceptance

- Understanding the Client/Entity & Its Environment

- Review of Litigation, Claims &Assessments

- Contingent Liabilities

- Related Party Transactions

- Internal Control

- Receipt of Cash from Customers

- Performing Audit Procedures & Evaluating Evidence

- Audit Sampling

- Analytical Procedures

- Ratio Analysis

- Internal Audit

- Use of Specialists in an Audit

- Auditing the Revenue (Sales)Cycle

- Auditing the Purchases & Cash Disbursements Cycle

- Other Processes Subject to Audit

- Sarbanes-Oxley Act of 2002 (SOX 2002)